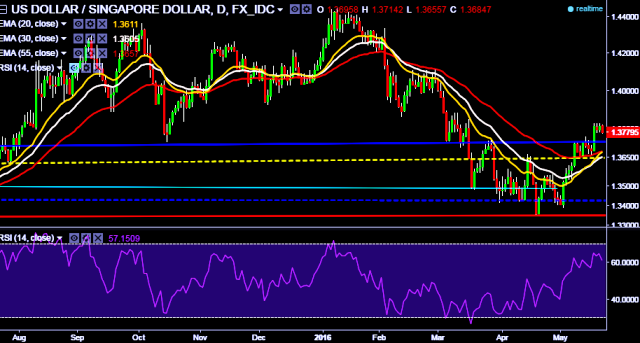

- USD/SGD is currently trading around 1.3780 marks.

- It made intraday high at 1.3820 and low at 1.3772 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 1.3828 levels.

- A sustained close above 1.3828 tests key resistances at 1.3851(March 16, 2016 high), 1.4073 (20D EMA) and 1.4132(20D, 30D and 55D EMA crossover).

- On the other side, a daily close below 1.3777 will drag the parity down towards key supports 1.3628 (55D EMA) /1.3548/1.3420 (April 13, 2016 low) /1.3357 (April 20, 2016 low) /1.3318/1.3302 levels.

- Today Singapore will release CPI as well as core CPI data at 0500 GMT.

We prefer to take short position in USD/SGD only below 1.38, stop loss 1.3828 and target 1.3715/ 1.3628 levels.